Dubai has a global reputation as an ideal destination for setting up businesses, providing advanced infrastructure, an inspiring business environment, and flexible laws that encourage investment. Opening a company in Dubai is a strategic step that requires planning and knowledge of the necessary procedures, whether in public or private companies, or in free zones that provide attractive financial and legal advantages. This requires achieving compliance with local laws and obtaining the necessary licenses, in addition to considering the financial and administrative aspects of the project. We will learn about many of the requirements for opening a company in Dubai through this article.

جدول المحتوى

ToggleSteps to establish a company in Dubai

To establish a company in Dubai , here are some basic steps, including choosing the type of company in terms of determining the appropriate type of company, whether it is an individual company, a private joint stock company, or a company in the free zone. There are some following steps:

- Selection of business activity: Determine the business activity that the company will engage in, and ensure its compliance with local regulations.

- Choosing a company name: Determine a unique and appropriate name for the company, and ensure that it is registered in accordance with legal procedures.

- Attracting partners (if any): If the company is participating, the partners must be identified, their shares determined, and the procedures related to that.

- Determine the location and region: Choose the company’s location, whether within Dubai or in one of the free zones such as Jebel Ali or Hamriyah.

- Preparing legal documents: Prepare and submit all legal documents required for registration, including the required agreements and approvals.

- Obtaining licenses and approvals: Request and obtain the necessary licenses from local authorities and relevant government agencies.

- Opening a bank account: Opening a bank account for the company to facilitate money operations and commercial transactions.

- Hiring employees (if necessary): Hiring employees necessary to start business operations and ensuring compliance with local labor laws.

- Registration of customer and supplier contracts: Securing and documenting relationships with your customers and suppliers, in line with local law requirements.

These steps form a general framework for the company establishment process in Dubai, and details can vary based on the type of company, geographic region, and chosen activities.

Cost of opening a company in Dubai

The costs of opening a company in Dubai vary based on several factors such as the type of company, the region in which it will be established, and the services that are used to help set up the company. Expenses may include:

- Registration fees: Costs of registering the company in the commercial registry and obtaining a business license.

- Legal and advisory services fees: To obtain the necessary legal support and advice during the construction process.

- Rental costs: for office or commercial space rent, if necessary.

- Administrative services fees: such as preparing documents and administrative procedures necessary for registration.

- Licensing costs: To obtain the necessary licenses from local authorities and government agencies.

- Costs of opening a bank account: To open a commercial bank account for the company.

- Additional services costs: such as hosting and technical support, if required.

To ensure accurate costs, it is recommended to contact local service providers or consulting companies to obtain accurate estimates based on the company’s specific needs and requirements.

Conditions for opening a company in Dubai

To open a company in Dubai , there are some basic conditions and requirements that must be met, and they usually include the following:

- Company type: The appropriate company type must be determined, whether it is an individual company, a joint stock company, or a free zone company, and compliance with the legal conditions specific to each type.

- Business Activity: The company’s activity must be compliant with local regulations and laws in Dubai, and must be accurately defined.

- Trade name: A unique name must be chosen for the company, ensure that it does not conflict with existing company names, and be registered in accordance with legal procedures.

- Location: The exact location of the company must be specified, whether it is within Dubai or in one of the free zones.

- Partners and shareholders: If the company is a joint-stock company, the partners and shareholders, the percentages of their shares, and the procedures related to them must be identified.

- Licenses and Permits: All necessary licenses and permits must be obtained from local authorities and government agencies, such as work license, professional and industrial licenses as needed.

- Legal Documents: All legal documents required for registration, such as necessary agreements and approvals, must be prepared and submitted.

- Required Capital: There may be requirements regarding the minimum capital required to start operating in some business activities.

- Tax Compliance: Must comply with local tax laws and adhere to necessary tax reporting and financial procedures.

These terms may vary based on the type of company and the region in which business operations are conducted in Dubai. To ensure full and smooth compliance with requirements, it is recommended to cooperate with Itqan Company consultants, which have extensive experience in this field

Types of companies in Dubai

In Dubai, there are several types of companies that can be established, varying according to the legal structure and business requirements. Here is a table showing the most prominent types of companies in Dubai:

| Company type | Description | comments |

|---|---|---|

| Sole proprietorship | A company managed by one person, who is solely responsible for the debts and obligations of the company. | Requires an Emirati citizen as a 51% shareholder. |

| Joint stock company | A company whose shareholders own shares in the capital, and profits are distributed according to their shares. | It can be a public or private company. |

| Company in the free zone | A company that enjoys tax and customs exemptions and flexible trade laws, which attracts foreign investments and facilitates access to global markets. | Models vary depending on the duty free zone. |

| Limited liability company | A company in which shareholders are liable for debts only equal to the value of their shares, not their personal funds. | Suitable for small and medium businesses. |

| Public company | A company whose shares are traded on the public financial market, and is subject to strict rules of disclosure and transparency. | It is subject to great supervision and regulation. |

| Partnership company | It is usually between partners who have a common interest in profits and losses, and who participate in the management of the company. | It can be a public or private partnership. |

This table provides an overview of the types of companies available in Dubai, and details can vary according to the laws of each type and the region in which the company is established.

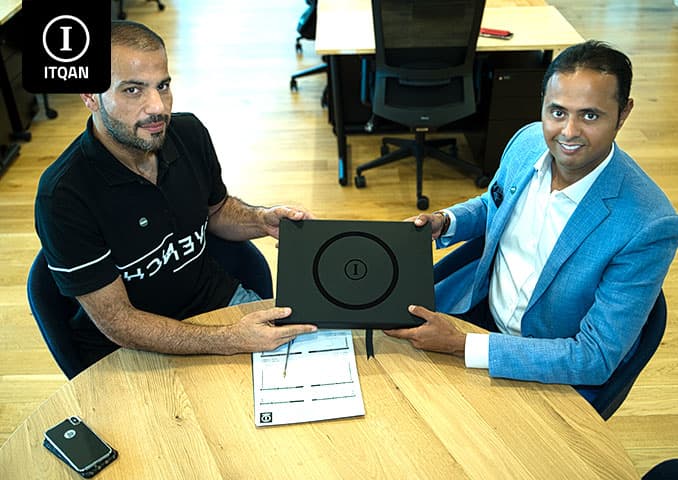

Commercial license to open a company in Dubai through Itqan Company

To obtain a commercial license to open a company in Dubai, Itqan Company can provide integrated and specialized services that include all the necessary steps. First, Itqan provides advanced consultations to determine the appropriate type of company and commercial activity according to the client’s requirements and local laws. The company helps prepare and organize all documents necessary to submit the application, including personal documents of the founders and lease contracts.

After that, Itqan is responsible for communicating with the relevant government authorities in Dubai to submit the application and follow up on it until the necessary approvals are obtained. The company also contributes to settling any legal or administrative issues that may arise during the process of obtaining a commercial license.

In addition, Itqan provides advanced project management and strategic planning services for new companies, ensuring full compliance with local laws and regulations and ongoing support after obtaining the license.

The importance of opening a company in Dubai

An advanced investment environment, as Dubai is considered one of the most prominent global centers for business and investment, as it provides advanced infrastructure and flexible laws that support international trade. In addition to the following advantages of opening a company in Dubai:

- Access to a global market: Dubai’s prime location facilitates access to the Middle East and North Africa markets, enhancing business opportunities and economic growth.

- Tax facilities: Dubai provides a flexible tax environment with no taxes on personal income or profits, which attracts investors and stimulates economic growth.

- Flexibility in company types: Various types of companies can be established in Dubai, including sole proprietorships, joint stock companies and companies in free zones, allowing investors to choose the structure that best suits their needs.

- Easy access to skilled workers: Dubai offers a dynamic, multinational labor market, making it easier for companies to attract global talent and build diverse and distinguished teams.

- Facilities for international business: Dubai free zones provide benefits such as exemptions from customs and customs duties, which helps speed up import and export operations.

- Culture of innovation and entrepreneurship: Dubai encourages innovation and entrepreneurship by supporting startups and innovative projects, making it an attractive center for entrepreneurs.

In short, opening a company in Dubai represents an important strategic step that opens up great opportunities for growth and expansion in a thriving global market, in addition to benefiting from an investment environment that supports innovation and economic development.

In conclusion of this article, it can be said that opening a company in Dubai represents a strategic step of great importance in the global business world. Dubai has an advanced investment environment, attracting investors thanks to its advanced infrastructure, flexible legal legislation, and supportive economic policies. Thanks to its distinguished geographical location and availability of tax and customs facilities, Dubai represents an ideal center for accessing regional and global markets.

Opening a company in Dubai not only benefits from diverse business opportunities, but also enhances the company’s position in the global business arena and provides a favorable environment for innovation and economic growth. In cooperation with specialized local advisors, investors can facilitate the company establishment process and ensure full compliance with legal requirements and local legislation.

Thus, everyone wishing to invest their economic future in the Middle East region should look to Dubai as a leading destination for establishing companies and benefiting from the vast opportunities available there.

Frequently asked questions about opening a company in Dubai

What are the approximate costs of setting up a company in Dubai?

Costs vary depending on the type of company and region, and include registration fees, legal costs, rental costs, etc., and you should consult local consultants for accurate estimates.

Can foreign companies operate in Dubai?

Yes, foreign companies can establish their branches or subsidiaries in Dubai under specific conditions that vary according to the type of company and its assigned activity.

What tax facilities do companies enjoy in Dubai?

Companies in Dubai enjoy no taxes on personal income or profits, which greatly attracts investors.

Does a foreign investor have to have a local partner to establish a company in Dubai?

It depends on the type of company. In some cases, a local partner is necessary, while companies in free zones or some other types can be set up without a local partnership.